Effective risk assessment is critical for compliance and strategic planning in today’s complex business environment. Risk assessment involves identifying, analyzing, and evaluating risks to minimize their impact on organizational objectives. With regulatory requirements becoming more stringent, businesses need robust mechanisms to ensure they remain compliant and safeguard their operations. This is where risk management platforms play a crucial role, providing comprehensive tools for accurate and efficient risk assessment.

Challenges in Conducting Risk Assessments

Conducting risk assessments is fraught with challenges. Traditional methods often fall short due to their manual nature, leading to errors, omissions, and inconsistencies. Key challenges include:

- Data Overload: Managing vast amounts of data from various sources can be overwhelming, leading to potential oversight of critical risk factors.

- Subjectivity: Risk assessments can be subjective, influenced by personal biases and perspectives, which can skew results and affect decision-making.

- Regulatory Complexity: Maintaining constantly changing regulations and ensuring compliance across multiple jurisdictions can be daunting.

- Resource Constraints: Many organizations lack the necessary resources to conduct thorough risk assessments, including time and expertise.

Benefits of Using a Risk Management Platform

Risk management platforms offer a technological solution to these challenges, providing a centralized, automated, and systematic approach to risk assessment. The benefits of using such platforms include:

- Data Integration and Analysis: These platforms can aggregate data from various sources, providing a holistic view of risks. Advanced analytics tools can then process this data, identifying trends and anomalies that may indicate potential risks.

For example, according to Gartner, organizations using integrated risk management solutions saw a 30% reduction in compliance costs and a 25% improvement in risk identification accuracy. - Objectivity and Consistency: Automated risk management tools minimize human biases, ensuring more objective and consistent assessments. This is crucial for maintaining the integrity of the risk assessment process.

- Regulatory Compliance: Risk management platforms are designed to keep up with regulatory changes, automatically updating compliance frameworks and guidelines. This ensures that organizations remain compliant with minimal effort.

- Efficiency and Cost Savings: Automation reduces the time and resources needed for risk assessments. A study by Forrester found that companies using risk management platforms experienced a 35% increase in assessment efficiency and a 20% reduction in related costs.

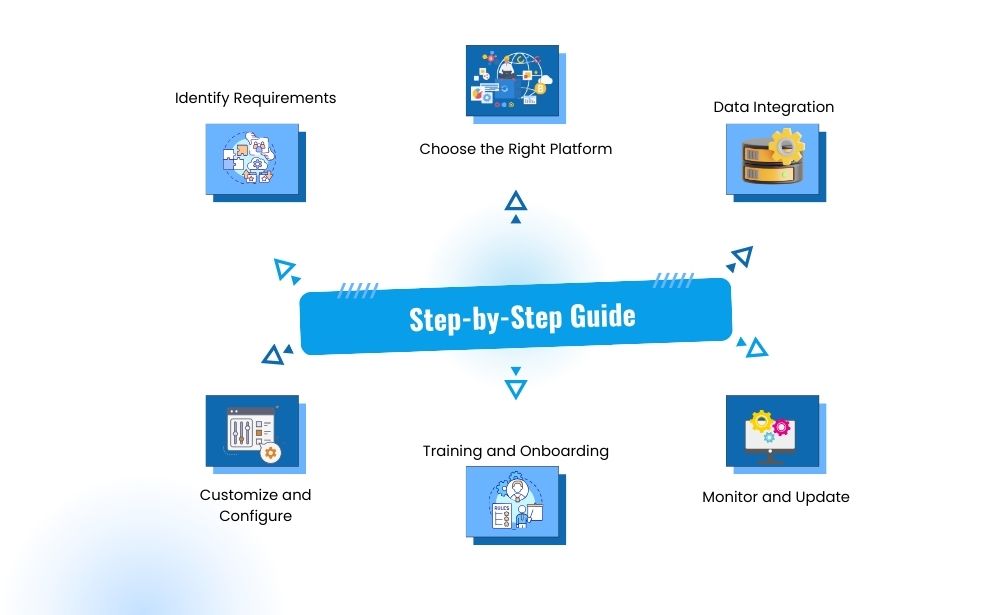

Step-by-Step Guide to Implementing a Risk Management Platform

Implementing a risk management platform involves several key steps to ensure it meets the specific needs of an organization:

- Identify Requirements: Assess your organization’s risk management needs and regulatory requirements. This will help in selecting a platform that aligns with your objectives.

- Choose the Right Platform: Evaluate different risk management platforms based on features, scalability, user-friendliness, and cost. Consider platforms like Asterdocs, RSA Archer, and MetricStream for their comprehensive risk management capabilities.

- Data Integration: Integrate the platform with your existing systems to ensure seamless data flow. This includes connecting with ERP systems, CRM systems, and other data sources.

- Customize and Configure: Tailor the platform to meet your specific risk assessment processes and compliance requirements. Configure workflows, dashboards, and reporting tools to suit your organizational structure.

- Training and Onboarding: Provide training for your staff to ensure they are proficient in using the platform. Effective onboarding can significantly enhance user adoption and the overall effectiveness of the risk management platform.

- Monitor and Update: Continuously monitor the platform’s performance and update it as needed. Regular audits and reviews will help in maintaining its effectiveness and ensuring it adapts to evolving risks and regulations.

Conclusion: Asterdocs’ Approach to Risk Assessment

Asterdocs offers a robust risk management platform designed to streamline and enhance the risk assessment process. By integrating advanced analytics, real-time data processing, and automated compliance updates, Asterdocs ensures that organizations can effectively manage their risks and stay compliant with regulatory requirements. With Asterdocs, businesses can achieve a comprehensive, accurate, and efficient risk assessment process, ultimately safeguarding their operations and enhancing strategic decision-making.

In conclusion, leveraging risk management platforms like Asterdocs for comprehensive risk assessment is not just a compliance necessity but a strategic advantage. By addressing the challenges of traditional risk assessments and reaping the benefits of automation and advanced analytics, organizations can significantly enhance their risk management capabilities.